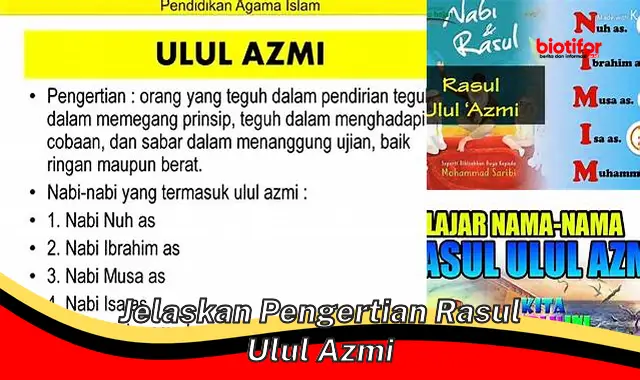

Rasul Ulul Azmi adalah sebutan bagi para rasul yang memiliki keteguhan hati yang luar biasa dalam menyampaikan ajaran Allah SWT. Keteguhan hati tersebut tergambar dari kesabaran mereka dalam menghadapi berbagai cobaan dan rintangan, serta kegigihan mereka dalam berdakwah menyebarkan agama Islam.

Para Rasul Ulul Azmi memiliki peran penting dalam sejarah penyebaran agama Islam. Mereka diutus kepada kaum yang memiliki hati yang keras dan sulit menerima ajaran baru. Namun, dengan kesabaran dan keteguhan hati mereka, para Rasul Ulul Azmi berhasil membawa banyak orang kepada jalan yang benar.